A credit score is a three-digit number. It represents your credit history and tells the lender the likelihood of you repaying your debt. It includes factors like how long your credit has been open, how much credit you have, and how much of it you use.

Whenever you apply for credit, such as when applying for a home loan, lenders and banks will use this number to decide if they will approve you for a loan. And if you get approved, this number will influence what the terms will be.

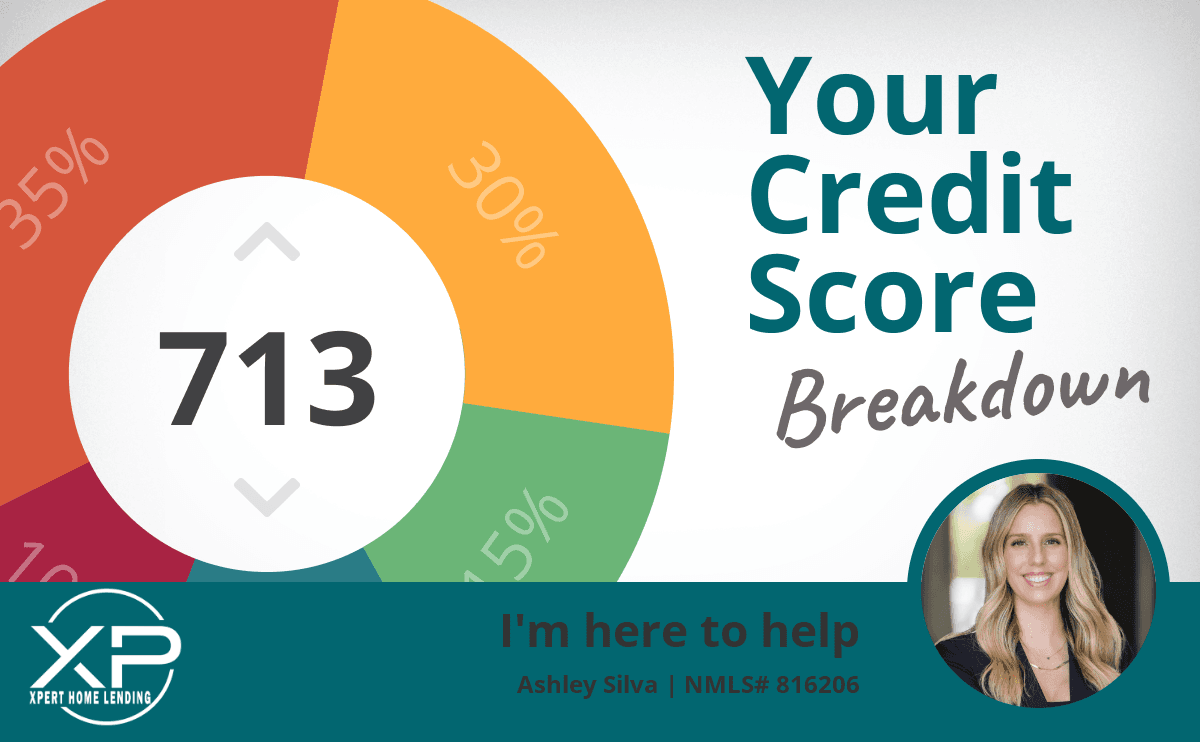

Your credit score is generated by the three main credit bureaus (Equifax, Experian, and TransUnion®) using a credit-scoring model. The most commonly used credit-scoring model is one developed by FICO®. It's based on several factors, like credit usage and available credit, but never on personal information such as race, gender, or ethnicity. Credit scores typically range from 300-850.

A "good" score varies slightly from lender to lender, but one thing remains the same --the higher your credit score, the better. A higher credit score tells lenders that you are low risk for defaulting on your loan, making it more likely that you get offered more credit and better loan terms.

Most lenders consider credit scores over 670 to be good. A credit score above 740 is very good, and any score of 800+ is exceptional.

For information purposes only. This is not an offer for extension of credit or a commitment to lend. Information and/or dates are subject to change without notice. | Financing is shown for comparison only. Rates and fees are subject to change without notice. | All loans are subject to borrower's credit approval and property qualification. Additional funds for reserves may be required. | Xpert Home Lending, Inc. | NMLS# 2179191 | CORPORATE: 1100 Satellite BLVD NW, Suwanee, GA 30024 | (417) 540-4858 | Equal Housing Opportunity | www.nmlsconsumeraccess.org