"Your cash to close will be way lower with us."

That’s the hook some lenders use to win your business.

But it’s also how they blindside borrowers — sometimes just days before closing.

→ Every month, we lose 1–2 borrowers to offers that look cheaper. But here’s what they don’t realize until it’s too late:

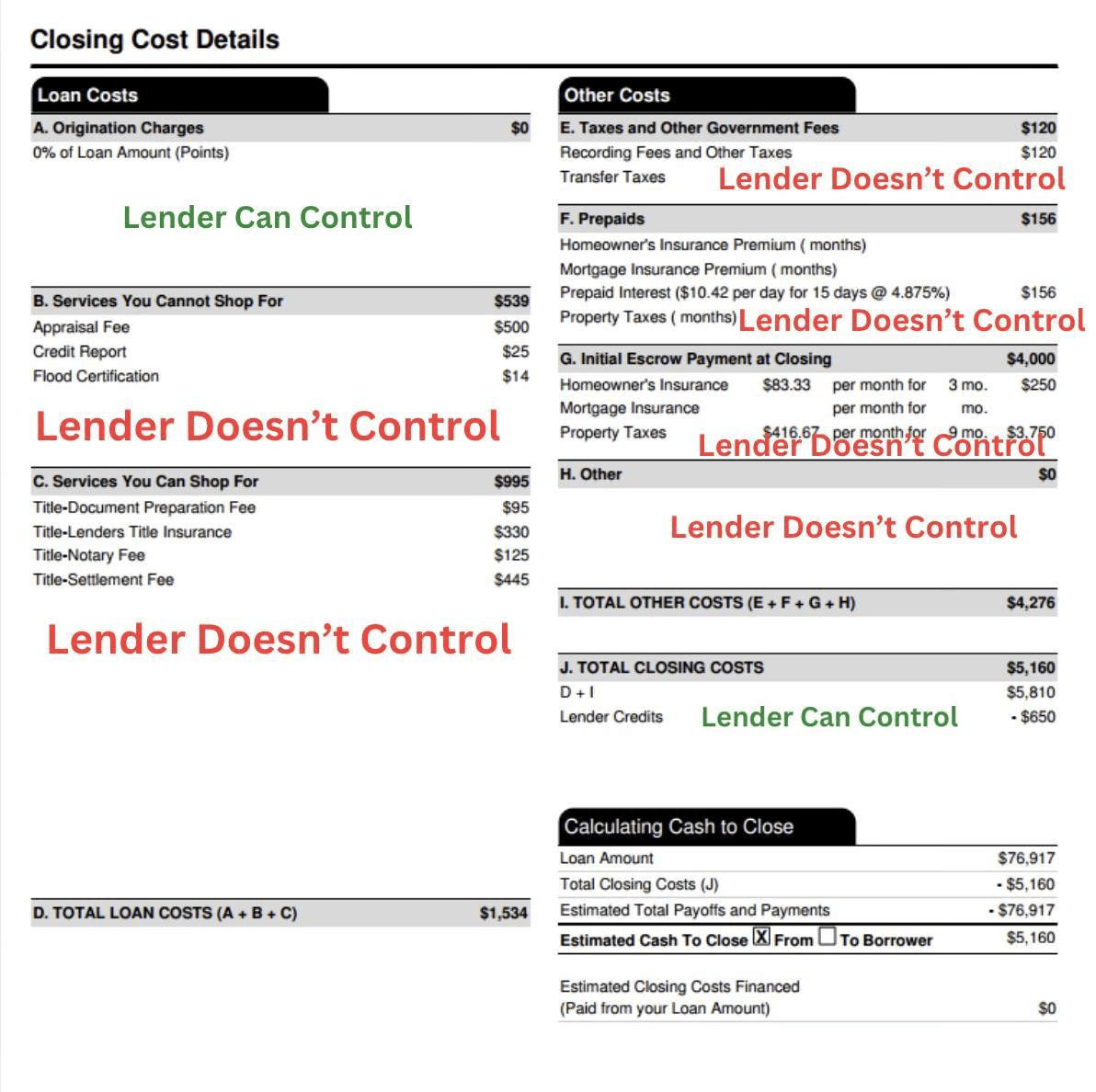

Lenders don’t control most of the closing costs.

- We don’t set your title or escrow fees.

- We don’t choose your homeowners insurance.

- We don’t set the rate for your property taxes.

- Even your closing date can impact thousands in prepaid interest.

Here’s a real example:

A borrower wanted to close on the 1st of the month. That meant 31 days of prepaid interest — $2,910 added to closing costs.

The competing quote? It showed only 1 day of interest: just $94. Their “cash to close” looked $2,816 cheaper.

But once we broke it down? That lender's actual fees were $1,300 more than ours.

They just manipulated the estimate to look better — and almost got away with it.

This is the game some lenders play:

- Lowball the estimate

- Leave out key costs

- Hope you won’t notice until it’s too late

Not us.

If that means we lose a deal? So be it.

Because we’d rather give you real numbers upfront — and have you feel confident and prepared at closing — than win a deal by being deceptive.

Don’t fall for spreadsheet tricks. Compare what’s real — not what’s been manipulated.

Below is a graphic to show you what we can and can't control in your loan estimate.